Why more companies should be running funds

Back your builders, grow your platform.

A few weeks ago, Gumroad acquired Small Bets, a profitable, community-first business built by Daniel Vassallo.

This move by Gumroad represents a shift in how tech companies are approaching their ecosystems.

Buried in Vassallo’s announcement was this:

“Small Bets will act as a laboratory… we’ll try to scale this idea of supporting builders.”

This stands out to me because it signals Gumroad’s strategic direction. Rather than treating builders just as users, they’re going to start actively helping them.

Sounds like a pretty altruistic move, but it’s more than that. It’s deeply strategic.

Why?

Because more and more companies are recognising that their success is tied to the success of the businesses built on their tool.

Let that sink in for a second.

By investing in their own ecosystem – sometimes through capital, sometimes mentorship or even community support – companies like Gumroad are reinforcing the very foundations of their platforms.

Let’s look at some real life examples.

Companies already investing in their ecosystems

Example 1: Shopify doubling-down on devs

Shopify Capital offers funding that merchants can use to grow their businesses. The more resources Shopify’s customers have, the more they thrive and in turn, so does Shopify's own growth.

And they haven’t stopped at merchant finance:

Shopify Fund (2011) – a $1 million pool that paid indie devs to build apps for the store.

0% rev-share on the first $1 million (2021) – dropped its App Store cut from 20% to 0%, resetting each year.

Those moves paid off: partners generated $12.5 billion in revenue in 2020 – more than 4× Shopify’s own.

Example 2: Slack’s $80 million bet on the future of work

Slack ran the same playbook for workplace software:

Slack Fund (2015) – an $80 million fund created with Accel, a16z and others to bankroll Slack-first apps.

Slack Fund II (2020) – doubled to $50 million, financed solely by Slack, now holding 85 + investments in tools like Lattice, Guru and Mural.

Slack Fund III (2022) – $100 million, now nearly 100 portfolio companies and a mandate to lead or co-lead rounds in tandem with Salesforce Ventures, giving Slack an even deeper seat at the future-of-work table.

Beyond capital, founders also get a dedicated Slack channel with the platform team, roadmap previews, and distribution inside the App Directory.

Example 3: Stripe’s founder-funding flywheel

Atlas + Startups (launched 2016) – one-click Delaware C-corp, US bank account, $100k fee-free processing, $50k in partner perks and a private founder community. Atlas alone onboarded 13,000 companies in 2023, up 37 % year-on-year.

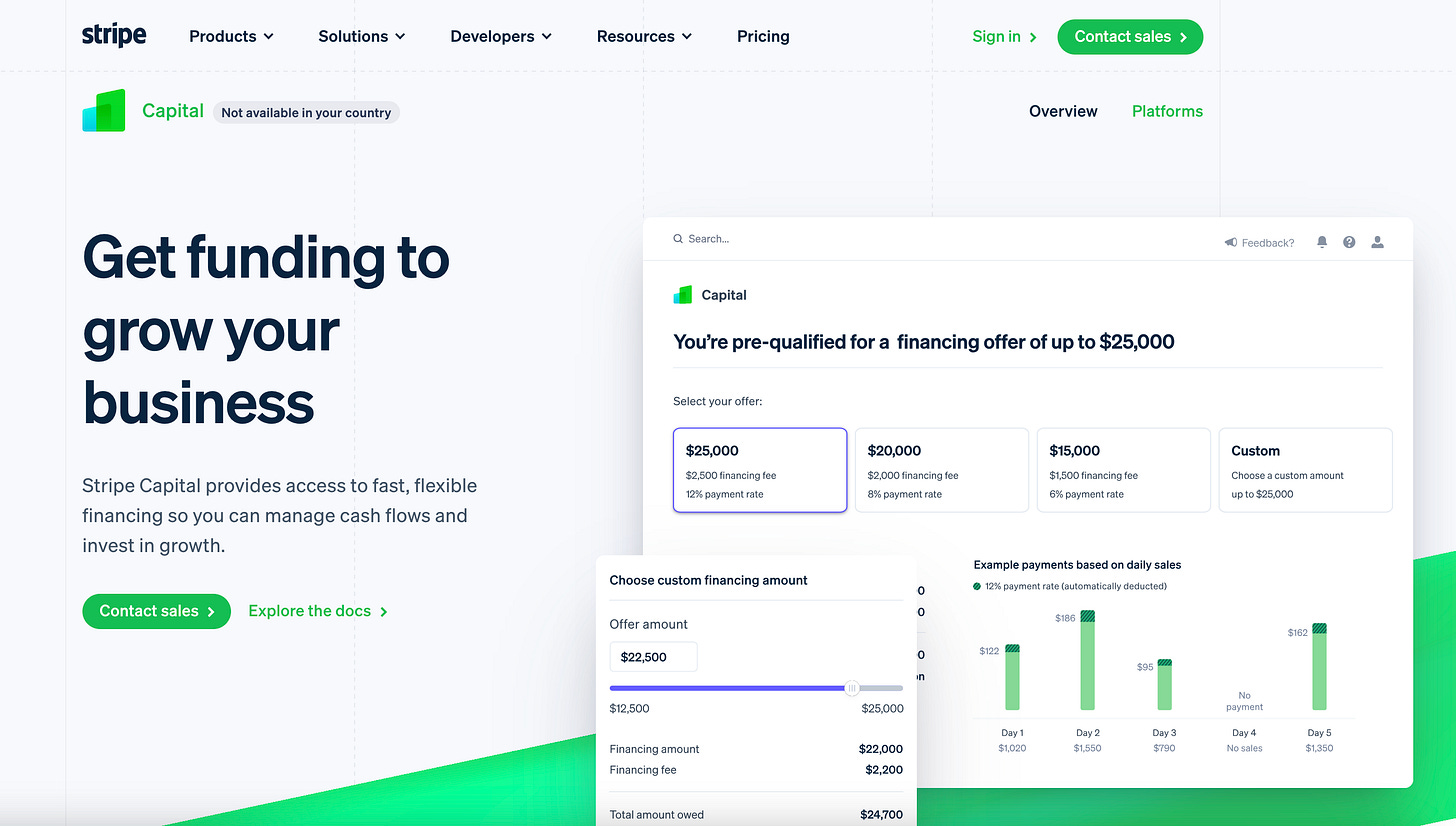

Stripe Capital (2019) – revenue-based financing pre-approved from merchants’ own Stripe data.

Atlas brings companies in, Startups lowers friction, Capital fuels growth – and all three lock Stripe in as the default payments layer.

In short, when platforms invest in their builders, they’re investing in themselves.

Why investing in your ecosystem makes sense

For companies, supporting builders (early, personally and directly) helps:

stay close to the builders in their orbit

deepen relationships

and gain early visibility into what’s being created next.

This model already exists at the high end – Google Ventures, OpenAI Fund, Salesforce Ventures are a few examples. But I believe there’s now a clear opportunity for smaller, founder-facing companies to do the same.

Dialling in on AI, funds would be a perfect growth vehicle for tools like Bolt, Cursor, and Replit. They’re surrounded by ambitious builders. A fund would give them a way to back that energy directly.

Owning a company-run fund also unlocks:

1. A front-row seat to emerging behaviour

Access to how builders are using your tools in ways you didn’t anticipate – features they’re hacking around, new categories forming etc – often before the market sees it.

This proximity keeps you close to the weird, early stuff, i.e. where future demand signals live.

2. A new dynamic between company and community

Put money on the table and the relationship flips from vendor → partner. That drives:

sticky brand affinity

deeper product feedback

embedded growth loops

a reputation that attracts the next wave of ambitious builders.

3. Long-term commercial upside

Founders you back early are far more likely to scale on (and evangelise) the platform that believed in them first.

Different models (it doesn’t have to be big or bureaucratic)

There’s no single blueprint for how a company should run a fund. But it might look like:

Off-balance-sheet – carve out a slice of treasury each year.

Formal VC vehicle – bring external LPs.

Product-embedded – bake funding directly into platform incentives.

A $1 million internal pool can deliver as much leverage as a $20 million venture fund if the audience is tight and the bets are thoughtful. The structure matters less than intent: get capital to the builders pushing the edge, and keep everything else lightweight.

It’s already happening at both ends of the spectrum. Salesforce and Google deploy venture capital with full infrastructure behind it. Newer players like Figma and Canva are setting aside slices of revenue or treasury to support early-stage founders in their orbit.

What we hope to see

The platforms that win the next decade will treat builders as collaborators, not customers – wiring money to them when the signal is still faint.

Do that, and the ecosystem pays you back in ways a standard marketing budget never could.

Which companies do you think should run a fund?

This makes a lot of sense. Creating these funds gives these funders exposure to innovation and a lot of upside.